The Virtual Cfo In Vancouver Diaries

Wiki Article

The smart Trick of Vancouver Accounting Firm That Nobody is Discussing

Table of ContentsThe Of Small Business Accounting Service In VancouverNot known Incorrect Statements About Cfo Company Vancouver Get This Report about Outsourced Cfo Services7 Simple Techniques For Small Business Accountant Vancouver

Not just will maintaining neat files and records assist you do your job more efficiently as well as precisely, yet it will certainly also send out a message to your employer and also customers that they can trust you to capably manage their monetary details with regard as well as honesty. Knowing the many projects you carry your plate, recognizing the deadline for each and every, and prioritizing your time as necessary will make you a remarkable possession to your company.

Whether you keep a thorough schedule, set up regular pointers on your phone, or have an everyday to-do listing, stay in charge of your routine. Also if you favor to hide out with the numbers, there's no obtaining around the fact that you will be needed to communicate in a selection of methods with coworkers, supervisors, clients, as well as sector specialists.

Also sending out well-crafted e-mails is a vital skill. If this is not your strong point, it may be well worth your effort and time to obtain some training to increase your value to a possible company. The audit field is one that experiences routine change, whether it remain in guidelines, tax obligation codes, software, or best techniques.

You'll find out crucial believing abilities to assist identify the long-lasting objectives of a business (as well as develop plans to accomplish them). As well as you'll learn exactly how to interact those strategies plainly as well as properly. Continue reading to discover what you'll be able do with an audit degree. CFO company Vancouver. With so numerous profession choices to select from, you may be surprised.

The Greatest Guide To Cfo Company Vancouver

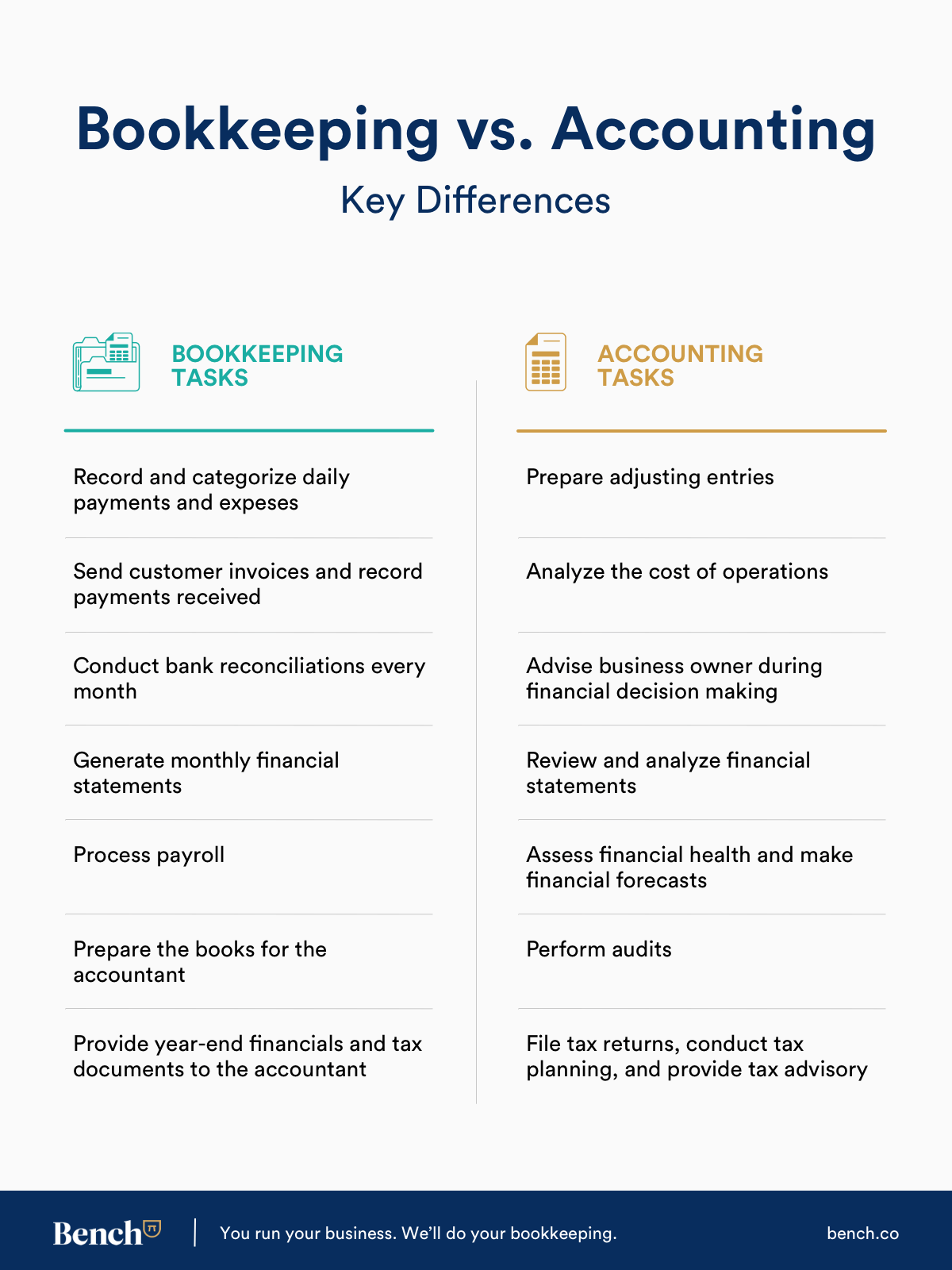

Exactly how much do accountants and also accountants bill for their solutions? Exactly how a lot do bookkeepers as well as accountants bill for their services?To recognize prices, it's valuable to know the difference in between accounting and accounting. These 2 terms are usually made use of reciprocally, but there is a substantial difference between accounting as well as bookkeeping services. We have actually written in detail about, however the very fundamental feature of an accountant is to tape-record the purchases of a company in a constant means.

Under the conventional approach, you won't recognize the amount of your costs until the job is complete as well as the provider has actually built up all of the minutes invested servicing your file. Although this is a typical pricing method, we discover a pair of points incorrect with it: - It develops a circumstance where customers really feel that they shouldn't ask concerns or gain from their bookkeepers and also accountants since they will certainly be on the clock as quickly as the phone is responded to.

All About Outsourced Cfo Services

If you're not pleased after completing the program, simply reach out and also we'll give a complete reimbursement with no inquiries asked. Now that we have actually discussed why we don't such as the traditional version, let's look at just how we value our services at Avalon.

we can be readily available to aid with bookkeeping as well as audit concerns throughout the year. - we prepare your year-end economic declarations and tax return (CFO company Vancouver). - we're below to assist with inquiries and support as required Systems arrangement as well as individually bookkeeping training - Annual year-end tax obligation filings - Advice with questions as required - We see a great deal of local business that have annual income between $200k and $350k, that have 1 or 2 CFO company Vancouver employees as well as are owner handled.

- we set up your cloud accountancy system as well as show you just how to submit records online and also check out records. - we cover the expense of the bookkeeping software.

5 Simple Techniques For Tax Consultant Vancouver

We're likewise readily available to respond to inquiries as they turn up. $1,500 for accountancy as well as pay-roll systems arrangement (single cost)From $800 monthly (includes software application charges and year-end costs billed regular monthly) As services expand, there is commonly an in-between size where they are not yet huge enough to have their very own interior finance department however are complicated enough that just employing a bookkeeper on Craigslist won't cut it.Report this wiki page